Against this background of a year of political change, Charterland has undertaken its sixth annual independent review of the Cayman Islands property market in order to measure any changes in the local real estate and construction markets.

As in previous editions, the Cayman Property Review is based upon data collection and analysis undertaken by qualified Chartered Surveyors, with many years of professional experience in the Cayman Islands, working in strict accordance with the Royal Institution ofChartered Surveyor’s Code of Conduct which requires Chartered Surveyors to act with independence, integrity and objectivity. Data is obtained by the review of every individual property transfer and lease, registered with the Cayman Islands Government’s Land Registry, for the calendar year of 2013.

Information on construction in the Cayman Islands is also obtained from the Cayman Islands Planning Department and an independent survey of contractors, architects and other property professionals.

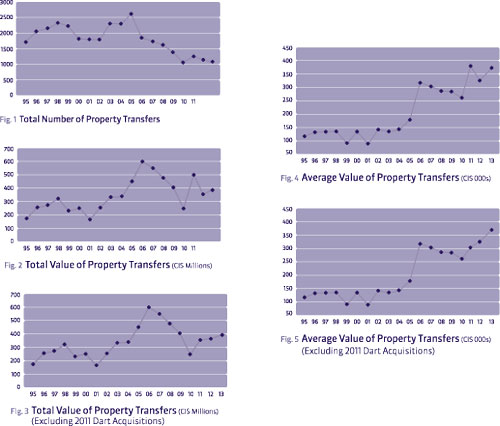

Based on Charterland’s detailed analysis, the total number of open market transfers registered with the Cayman Islands Government’s Land Registry for 2013 was 1,074. This figure is approx. 6% down on the total number for 2012 of 1,141. This number is, however, still slightly higher than the market low in 2010 of 1,015 transactions for market value in the calendar year (Fig 1).

What is significant for 2013, though, is that the decrease in the number of transfers, when compared to 2012, is not reflected in the total value of the sales. Indeed, the total value of the transactions in 2013 actually increased by approx. 7% over the total value of sales for 2012. A total value of CI$392.83 million in 2013 compared with total sales of CI$367.75 million being registered in 2012(Fig 2).

Regular readers of the Cayman Property Review will recognise that the high value of the total sales in 2011 is a result of the significant acquisitions made by the ‘Dart Group’ in 2011, which represented 28% of the total value of all the property transfers for that year. Thus, if we ignore these specific acquisitions by Dart on the basis that they created a distortion to the market, we see that the total value of transfers per year has been increasing steadily since the low point in the market of 2010 (Fig. 3).

The increase in the total value of sales in 2013, despite the slight drop in the actual number of transfers for the same period, has resulted in a positive impact on the average value of the transfers, with the average value for 2013 of CI$365,800 being a significant 13.5% increase over the average value of 2012 of CI$321,700 (Fig 4).This does not, of course, mean that the market value for all properties in the Cayman Islands have increased by this figure during 2013, but it is certainly a positive market indicator, notwithstanding the low number of actual transfers.

Similar to the total value of the transfers, it is clear to see from the graph the distortion in the market created by the 2011 Dart acquisitions; however, by again excluding these sales from the data set, a general uplift in the market since 2010 is evident (Fig 5).

Indeed, the average value of the total sales in 2013 has now exceeded the high point in 2006, although this observation should be tempered by the fact that the total number of open market sales in 2013 of 1,074 is still 43% lower than the total number of sales during 2006, suggesting that any recovery in the market is still a fragile one due to the limited number of actual transactions when compared with the height of the market.

Further information on the real estate and construction market in the Cayman Islands through to the end of 2013 can be found in the full version of the Cayman Property Review 2013 which can be downloaded for free at www.charterland.ky